BUSINESS VALUATION

Statistics show that 65% of business owners do not know what their company is worth and in fact many literally go decades without assessing the value of their business, however, at the same time 70% to 90% of the net worth of these business owners is tied up in their business.

WHERE ARE YOU NOW? WE START WITH AN ASSESSMENT.

Our assessment process was developed based on worldwide market research and 20 years of practical experience looking at the characteristics of successful businesses.

Why should I want to know what my business is worth?

You have worked hard to build this asset, and you should know the value of your hard work in the present and for the future.

Here are just a few reasons why you should consider an annual business valuation….

- A business valuation helps establish a baseline value that enables you to create more informed financial goals, business strategies, and marketing objectives.

- Annual business valuations allow you to understand your company’s potential for growth and innovation.

- A business valuation serves as a useful tool for setting targets for management.

- Lenders often require a business valuation before signing off on a loan, depending on the size and type of business. Specialized businesses may face more unique challenges in the economy and their respective markets, so values understandably shift. A business valuation helps the lender help you.

- You might feel far from ready to sell but, what if an amazing opportunity showed up on your doorstep or a life issue like illness put you in a situation where a sale was suddenly necessary?

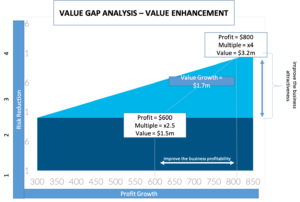

Business Value is often Simple Math or is it….

- The formula for calculating Business Value: Adjusted EBITDA times a Multiple?

- Adjusted EBITDA is defined as Earnings Before Interest, Taxes, Depreciation, and Amortization, adjusted for personal expenses unique to the current owner(s).

- The Multiple is subjective and is what the Buyer is willing to pay on their perceived ability to continue generating profits and the risks of doing so.

- Companies generally sell between 1 and 6 times EBITDA; top performers or Companies that provide a strategic advantage for the Acquirer sell significantly higher than 6.